Payments trends for 2023 in Latin America and Africa

As consumer immediacy spikes, innovations in the payments industry and new ways to sell online are created, especially in regions considered rising economies, such as Africa and Latin America. Both Africans and Latin Americans are experiencing a payments revolution, so get your business ready and learn more about the hottest payment methods in these growing economies and what to expect from 2023 and onwards!

João Paulo Notini

December 13, 2022

As consumer immediacy spikes, innovations in the payments industry and new ways to sell online are created, especially in regions considered rising economies, such as Africa and Latin America.

The more global and digitalized the world gets, the more consumption habits change. This has a direct impact on the way how people pay and, consequently, on digital commerce sales. As consumer immediacy spikes, innovations in the payments industry and new ways to sell online are created, especially in regions considered rising economies, such as Africa and Latin America. Both Africans and Latin Americans are experiencing a payments revolution, so get your business ready and learn more about the hottest payment methods in these growing economies and what to expect from 2023 and onwards!

How do Africans and Latin Americans buy and pay online?

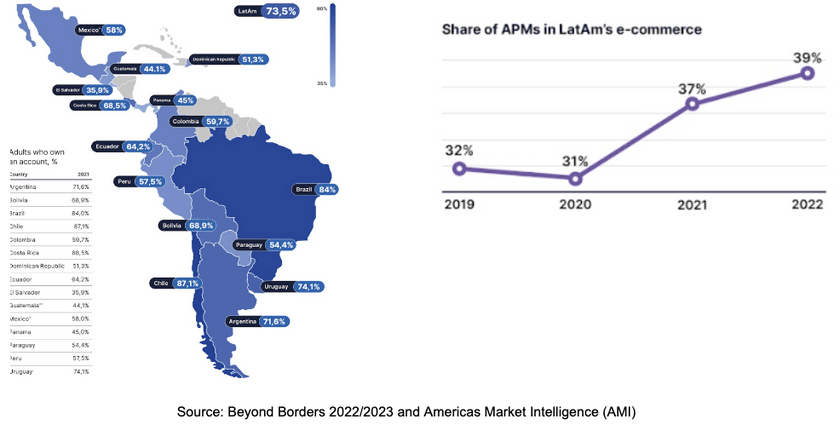

Thanks, but no banks. Rising economies are well known for their high smartphone penetration and low access to credit cards and bank accounts. In Latin America (LatAm), for example, smartphone penetration reaches 74% of internet users – as per Insider Intelligence – while, in Africa, there is an 83% penetration of mobile subscribers, as reported by the International Telecommunication Union (ITU).

Yet, while in LatAm smartphone penetration helped boost online shopping and, later, digital payments, in Africa the high degree of mobile usage has been the foundation for payments and financial access itself. In other words, while e-commerce drove digital payments adoption in Latin America, in Africa digital payments should drive e-commerce.

Latin America: where alternative payment methods are becoming the norm for online purchases

Alternative Payment Methods (APMs), such as bank transfers and digital wallets, are on the rise in Latin America – with new digital consumers bringing a diversity of payments and access into e-commerce. As reported by EBANX’s annual study, Beyond Borders 2022-2023, APMs share is expected to reach almost 40% of the e-commerce volume in the region, jumping from 31% just two years ago, with peaks of 55% in Colombia and 46% in Brazil.

The drivers of this phenomenon are BNPL (Buy Now, Pay Later) solutions, instant bank transfers, and digital wallets – all of them bringing more diversity to the payments landscape in LatAm and working for cash displacement in the region.

“Regardless of the unprecedented financial inclusion in the region, alternative payments continue to be a big deal in Latin America, driving financial innovation and online shopping. And this is often overlooked.”

João Del Valle, co-founder, and CEO of EBANX, in a statement to Beyond Borders 2022/2023

Africa: a digital commerce market pushed by alternative payment methods

Africa is home to more than 1 billion people, with the youngest median age in the world (only 18 years old, per the United Nations), and more than this: with a strong preference for digital alternative payment methods. Just like in LatAm, APMs thrive in Africa’s digital commerce, a region where 97% of the population doesn’t have a credit card, as reported by the World Bank.

By the end of 2021, 46% of online transactions in Africa were made through digital payments, such as e-wallets, mobile money, and instant transfers, according to the World Bank and Insider Intelligence. The preference for these payment methods is higher among lower-income online consumers, while high-income shoppers just buy with their credit cards, as shown by Deloitte’s recent study on Digital Commerce in South Africa.

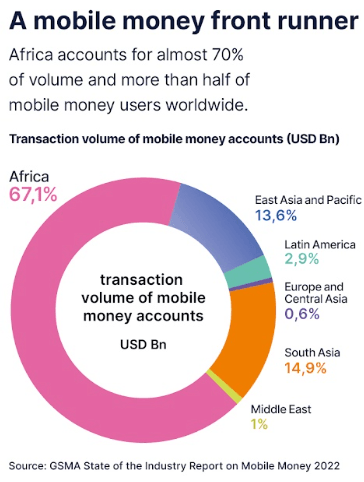

The mix of payment methods varies from country to country. In Nigeria, account-based transfers and debit cards prevail. In Kenya and Ghana, where there’s lower bank penetration, mobile money reigns; and in South Africa, it is cards, as stated by McKinsey & Company. However, when we talk about mobile money, the African continent accounts for nearly 70% of the volume and more than half of mobile money users worldwide.

“Telecom companies have been a major catalyst for financial inclusion in Africa,”

Juliana Etcheverry, director of Strategic Payments Partnerships at EBANX, in a statement to Beyond Borders 2022/2023

The Hottest Payment Methods in Latin America and Africa

Instant Payments

Fast, safe, trustworthy, and instant transactions. More than 60 jurisdictions across all continents have launched instant payment systems, as stated by a recent report from BIS. The growing momentum for account-based transfers in LatAm, for example, is being pushed by two major players: Pix in Brazil and PSE in Colombia, which represent 90% of the volume in the region.

Other smaller solutions are also gaining traction, such as SPEI in Mexico, Sinpe Móvil in Costa Rica, Simple in Bolivia, Pagos al Instante in Dominican Republic, and SafetyPay (a regional payment solution that enables account-based transfers for e-commerce purchases, with a stronger presence in the travel vertical).

Meanwhile, at least six countries in Africa already have active real-time payment initiatives, such as Nigeria’s NIP, Kenya’s PesaLink, and South Africa’s RTC, based on the ACI Worldwide report. Nigeria ranks 6th among the countries with the largest volumes of instant payments worldwide, with USD 3.7 billion in transactions in 2021, per the same report.

Digital Wallets

Digital wallets, also known as e-wallets, are definitely a powerful APM in rising economies such as LatAm and Africa. They allow customers to pay for purchases with their chosen wallet by scanning a QR Code or simply confirming the transaction after logging into their accounts. This payment method reduces fraudulent chargebacks by requiring customers to access their apps and accounts.

Over the last years, for example, digital wallets have been among the top-3 payment methods in LatAm’s digital commerce, just behind cards and account-based transfers (including instant payments). Meanwhile, in Africa, e-wallets are growing fast, and, as attested by McKinsey’s study, they will account for 70% of all the digital commerce volume in the region by 2025.

Several e-wallets and mobile money options are available in both LatAm and Africa. Yet, some successful examples include Mercado Pago in seven Latin American countries, Nequi in Colombia, PicPay and AME in Brazil, Mukuru in 20 African countries, M-Pesa in Kenya, SANEF in Nigeria, and Fawry in Egypt.

Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) solutions are interest-free loans embedded at the point of sale. Different from installments, BNPL is a new payment method (not a feature within cards) that does not require a card or an account, and it’s offered directly by fintech or e-commerce players through a digitized credit analysis.

BNPL solutions are expected to grow at a 21% CAGR over the next four years worldwide. Among rising economies, they are more common in LatAm and, although they are expected to represent only 1% of all online purchases in the region during 2022 – according to AMI – there are some successful experiences in Latin America, such as Cuotas in Argentina, Koin in Brazil, Sistecredito in Colombia, and Kueski in Mexico.

Payment trends for 2023 and onwards

Rising economies are driving the future of payments. APMs, such as instant payments, digital wallets, and BNPL solutions, are expected to keep growing at astonishing rates across the globe. It’s not only about reaching a larger share of the market but also about addressing cultural preferences, reducing costs, and building trust among consumers.

For rising economies, this phenomenon is even more intense. So, let’s have a look at what should happen in LatAm and Africa.

Less physical cash and more alternative, digital, and instant payment methods in Latin America

The rise of alternative payment methods will also directly impact physical cash in LatAm. Cash-based payments are doomed to keep shrinking, and the share in Latin American digital commerce should be only 7% by 2025.

Instant payments are both the present and future of payments in the digital commerce of rising economies. Considering LatAm, they are expected to reach almost 20% of the region’s digital commerce in 2022. Also, based on a report from ACI Worldwide, they should grow at a 25.6% annual rate (CAGR) through 2026, reaching about a quarter of all electronic payments globally.

Following the same trend, digital wallets are expected to represent a consistent 10% share of all online transactions in LatAm over the next few years – growing around 20% per year on the region’s digital commerce through 2025, as per AMI and Beyond Borders 2022-2023.

“Regardless of the unprecedented financial inclusion in the region, alternative payments continue to be a big deal in the region, driving financial innovation and online shopping. And this is often overlooked.”

João Del Valle, co-founder, and CEO of EBANX, in a statement to Beyond Borders 2022/2023

Payment innovations will continue to be a key driver for Africa

By 2025, at least 70% of all online transactions in Africa are expected to be done with alternative payment methods, while cards will only represent 30% of the volume, as pointed out by McKinsey & Company.

The research points out that digital wallets should be the fastest-growing payment method in the continent, expanding at 25% per year through 2025 (for both online and offline transactions). Cards come next, growing 20% per year, while electronic transfers will be a bit behind at 18%. More disruptive technologies, such as cryptocurrencies, stablecoins, and CBDCs (Central Bank Digital Currencies), are also seen as strong possibilities for the future of payments in Africa, “given the promising use cases and the historical tendency of Africa to embrace innovation at scale and leapfrog into the future,” according to McKinsey’s analysis.

“Payment innovation has been a key growth driver for Africa.”

Anthony Oduu, co-founder and CTO at Nigerian fintech Verto, in a statement to Beyond Borders 2022/2023

Key Takeaways

The low access to credit cards, lack of financial inclusion, and high penetration of smartphones are driving the strong preference for alternative payment methods (APMs) in rising economies, especially in Latin American and African countries. Despite solving financial access issues, the adoption of APMs fosters online shopping and vice-versa.

We have shown, in this article, several APMs which are becoming increasingly popular at a country or regional level. Thus, considering these growing economies and their digital commerce markets, consumer behavior has changed compared to a few years ago. Now, digital, alternative, and more inclusive payment methods such as instant payments and digital wallets are growing fast, while physical cash is doomed to keep shrinking. By 2025, at least 70% of all online transactions in Africa are expected to be done through APMs. Meanwhile, in Latin America, cash-based payments should account for only 7% of the total online sales volume during the same period.

Do you want to keep learning about market and payment trends in both Latin America and Africa while also discovering the real potential for different online cross-border business industries? Then, check out the fourth edition of Beyond Borders – EBANX annual study.

You will have the chance to get to know all the ultimate digital commerce and payment trends in growing markets, supported by fresh data and influential industry experts’ statements.

By reading it, you will track down the following:

- The vast advance of cross-border in Latin America

- Africa: a hyper-growing, mobile-driven digital market

- Alternative payments in rising economies

- Leading verticals growing double-digits

- The Latin American SaaS & Cloud boom

Talk to a payment expert

PIX: The revolutionary instant payment in Brazil

Safer, cheaper, and instant. Time to learn about PIX: the revolutionary payment method in Brazil