The digital market potential for Latin America and Africa in 2023

From the concept of “rising economies” to all their market potential in numbers and key insights. Sit back and get ready to discover more about these places and how cross-border businesses could explore their full potential.

João Paulo Notini

December 09, 2022

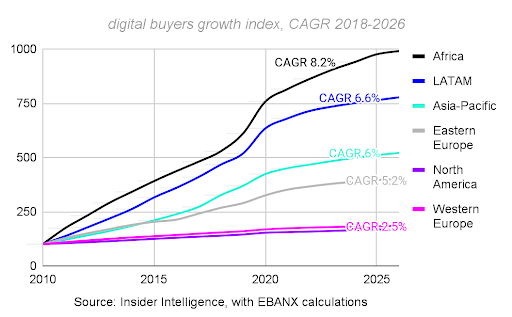

Presenting unparalleled digital commerce market opportunities and double-digit sales growth rates, Africa and Latin America are also the first and second fastest-growing regions in the number of digital buyers.

Presenting unparalleled digital commerce market opportunities and double-digit sales growth rates, Africa and Latin America are also the first and second fastest-growing regions in the number of digital buyers. What else do they have in common? Well, they are both considered “rising economies”, and we are here to show you why your global business shouldn’t overlook them.

From the concept of “rising economies” to all their market potential in numbers and key insights. Sit back and get ready to discover more about these places and how cross-border businesses could explore their full potential.

What are rising economies?

Have you ever heard the term: “rising economies”? Well, even if you didn’t, you might have been interested in, or your business already operates in at least one of them.

This concept refers to countries and/or regions growing economically and presenting unparalleled market opportunities.

E-commerce and digital payments – the bridge between businesses and people in Africa and Latin America

Despite being hypergrowth digital commerce markets, rising economies share other common characteristics, especially regarding payments and online consumer behavior.

First, bear in mind that, although these regions are growing economically, a great share of the population is still unbanked or doesn’t have access to credit – only 28% of Latin Americans and 3% of all Africans have credit cards, as per the World Bank and EBANX 2022-2023 Beyond Borders study.

So, why are these markets so attractive for global companies? The answer relies on the strong adoption of digital alternative payment methods (APMs) – which are anything but cards – and high smartphone penetration by the local population in these places. In our Beyond Borders study, we have proved how this combination has been driving financial access and inclusion, enabling digital buyers to purchase from cross-border businesses more conveniently, faster, and cheaper.

“The key aspect here is accessibility; it is giving credit in an easy way to the right people: those who are good payers but have difficulties in proving their scores.”

Erika Daguani, VP of Product at EBANX in a statement to Beyond Borders 2022/2023.

For global companies which are currently operating or willing to operate in LatAm and/or Africa, investing in digital alternative payment methods such as instant payments, digital wallets, and vouchers has several benefits.

It’s not just about reaching a larger share of the market and making digital products and services available for those who don’t have a credit card – but it’s equally important to address cultural preferences, reduce costs, and build trust among consumers.

Moreover, it helps to gain consumers’ trust and raise the average order value (AOV). As per EBANX’s internal data considering the first three quarters of 2022, the AOV is 4% higher with APMs in comparison with cards, and account-based transfers and cash vouchers payments, such as OXXO in Mexico, drove the highest AOV of all payment methods.

Latin America – the Eldorado for cross-border e-commerce sales

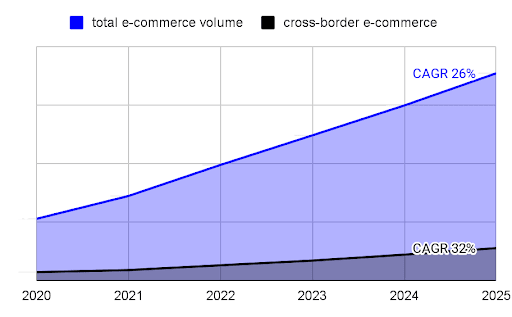

LatAm is definitely a place to be for cross-border businesses. After two years of slowdown, the cross-border online market in the region is back on track and will expand almost 45% in 2022, according to Beyond Borders 2022-2023 and AMI (Americas Market Intelligence) – nearly 10 percentage points higher than the domestic market, with 36%. A truly Eldorado for companies selling globally, right?

A global battlefield: International online market grows faster than domestic in Latin America

“Cross-border really took a hit during the pandemic and now the market is finally readjusting.”

Lindsay Lehr, Payments Practice Director at AMI in her statement for Beyond Borders 2022/2023.

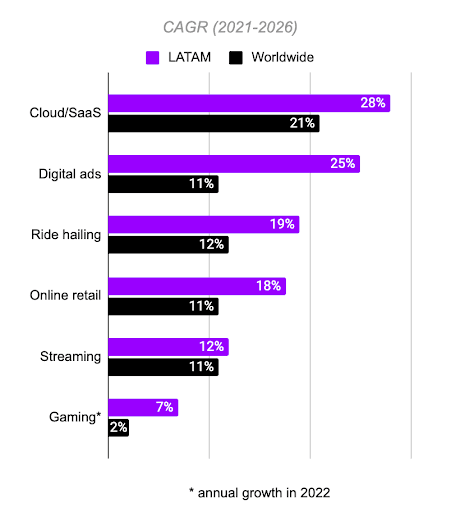

This hypergrowth scenario should continue to exist in the next few years, and with international online sales accelerating at an average of 34% per year through 2025 in the region, industries such as gaming, online retail, streaming, and SaaS are recording double-digit growth in cross-border commerce.

A hyper-growth region: Digital verticals in Latin America are growing up to 3x the global average

Africa – the next Latin America for global digital companies

Can you imagine 1.3 billion people getting more and more access to cross-border goods and services? Africa is ready to become the next Latin America. The continent has been revolutionizing the global payments scheme while cross-border sales have gained traction.

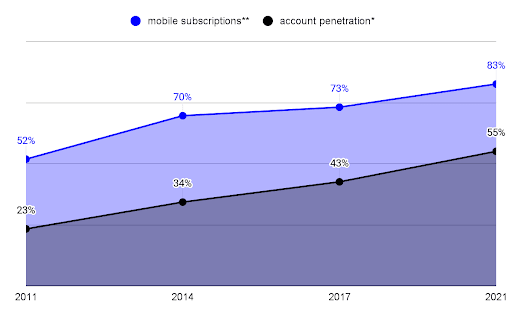

Just like other rising economies, it has a strong smartphone adoption and, surprisingly, there are more cell phones than bank accounts there. Moreover, nowadays 360 million Africans are using the internet, and this has created the perfect scenario for a hyper-growing digital market to emerge.

More cellphones than bank accounts: Mobile access has been driving financial inclusion in Africa

Similarly to LatAm, APMs play a crucial role in Africa’s digital commerce. As reported by McKinsey, by 2025 at least 70% of all online transactions in the continent are expected to be done with alternative payment methods, such as digital wallets, mobile money, and instant payments. In this scenario, cards only represent around 30% of online volume.

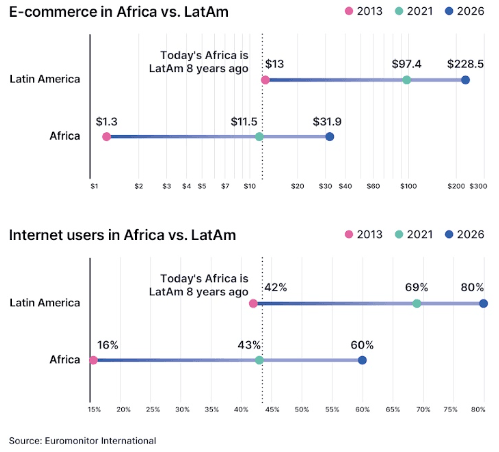

If we compare the numbers, Africa’s digital commerce is where LatAm was a decade ago – with equivalent internet users, mobile penetration, online buyers, and sales volume. During this period, LatAm’s online commerce grew by about 30% per year, even though digital payments were just embryonic. So, can you imagine how huge is the potential here?

Africa is where LatAm was a decade ago

The levels of its internet users and e-commerce volume are equivalent

“Africa is poised to leapfrog other regions. We built the foundations and are now at an inflection point for the rapid explosion of digital commerce and financial services.”

Derin Adebayo, Global Lead of Access to Capital at Endeavor in a statement to Beyond Borders 2022/2023.

Key takeaways

You have now understood the unparalleled potential of rising economies, especially in LatAm and Africa. With double-digit growth rates and more than a billion potential online shoppers, their digital commerce markets can’t be overlooked by cross-border businesses.

There are, however, particularities that must be taken into account, such as the key role of digital APMs in places where a great share of the local population lacks access to credit cards and/or bank accounts. These payment methods include instant payments, digital wallets, vouchers, or anything but cards and have several benefits for companies that offer them, such as reduced costs and higher customer satisfaction.

After two years of slowdown, the cross-border online market in LatAm resumed its hypergrowth trends, and it is ready to grow 34% per year through 2025. Meanwhile, Africa can be considered the new Latin America since, if we compare the numbers, its digital commerce is actually where LatAm was a decade ago. The region also has the highest growth rate in the world in terms of digital buyers and shares the same characteristics as all other rising economies: hypergrowth markets, strong uptake of digital technologies, a young population, high smartphone penetration, and an increased preference for APMs.

If you have enjoyed your read, get ready to dive deeper into the rising economies’ world and discover more key insights! All the data presented here was retrieved from the fourth edition of Beyond Borders – EBANX annual study.

You will have the chance to get to know all the ultimate digital commerce and payment trends in growing markets, supported by fresh data and influential industry experts’ statements.

By reading it, you will track down the following:

- The vast advance of cross-border in Latin America

- Africa: a hyper-growing, mobile-driven digital market

- Alternative payments in rising economies

- Leading verticals growing double-digits

- The Latin American SaaS & Cloud boom

Talk to a payment expert

Our annual study is out! Beyond Borders 2021-2022

Beyond Borders 2021-2022: How digital payments and e‑commerce are gaining traction in Latin America